The banking industry in Australia is at a fascinating crossroads, according to reports. Traditional branches are shrinking, mobile and digital channels are multiplying, and customer expectations are evolving faster than ever.

According to the Australian Prudential Regulation Authority, over 500 bank branches closed between 2020 and 2024. This is a clear signal that location strategy is no longer just about real estate, but also about location analytics.

This is where Maplytics could add value. Natively integrated with Microsoft Dynamics 365, Power Apps, Power Pages, and Dataverse, this certified geo-analytical solution could bring a location intelligence layer to the banking operations. It helps institutions make smarter decisions about outreach, branch optimization, lending patterns, customer engagement, and more.

For Australian banks, Maplytics could be a strategic lever that connects people, places, and performance in real time.

Let’s explore eight ways Maplytics can revolutionize how banks in Australia operate.

1. Rethinking Branch Footprints with Location Intelligence

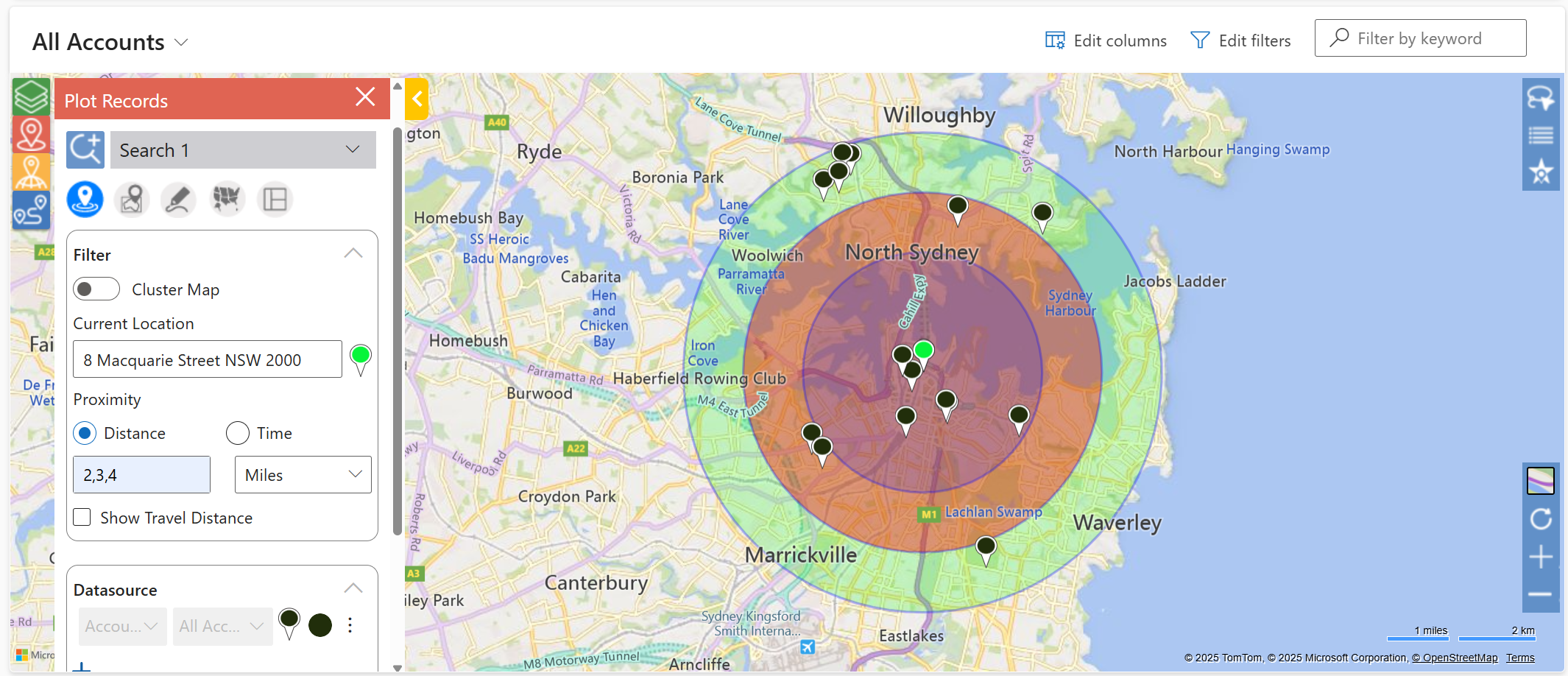

Australia has seen a steady reduction in physical bank branches. But this reduction doesn’t have to mean reduced access. With Maplytics, banks can visualize customer density, transaction hotspots, and service gaps on interactive maps.

If a major bank wants to rationalize its branches in New South Wales, it can layer its demographic data and customer activity from Dynamics 365. It can check the geographic coverage and identify low-footfall branches and high-demand zones. Instead of shutting down blindly, it can redirect resources strategically, closing a few locations while setting up mobile branches in underserved areas.

This could turn a cost-cutting exercise into a customer-first strategy.

2. Smarter Territory Planning for Relationship Managers

Sales and relationship managers are often responsible for thousands of clients spread across wide geographies. Driving up and down the M1 without a clear plan wastes time, petrol, and opportunities.

Maplytics enables territory segmentation & management using real-world geography, travel time, and CRM data. Using this, managers can define territories based on customer value, lending portfolios, or business type, and balance workloads across teams.

If a commercial banking team covering Greater Melbourne uses Maplytics to reorganize its relationship manager territories. By factoring in both client density and travel time, they cut average daily travel by 35%, allowing each manager to meet more clients per week. This would also reduce the number of unattended clients in all these strategic territories.

3. Micro-Targeted Campaigns for Lending and Mortgages

In a competitive lending environment, precision matters. Instead of generic mass outreach, Maplytics can enable banks to identify pockets of opportunity.

They could use demographic overlays to find areas with growing young families (potential first-home buyers). Run a radius/proximity search around new housing developments and launch hyper-local campaigns through sales reps or digital channels.

A Queensland bank identifies three fast-growing suburbs on the Sunshine Coast where mortgage applications have spiked. Instead of city-wide campaigns, it deploys a targeted outreach team to host info sessions in community centers and real estate offices nearby. Thus, yielding higher lead conversion at a lower cost.

4. Field Visit Optimization for Financial Advisors

Banking isn’t all done online. High-value clients still value face-to-face interaction. Financial advisors and mobile lenders often visit clients at their homes or offices. Maplytics provides route optimization to create the most efficient multi-stop routes, factoring in real-time traffic and appointment schedules.

Consider a personal banker in Sydney who has six client meetings across Parramatta, Burwood, and the CBD in one day. Instead of manually mapping routes, Maplytics auto-generates a planned schedule and an optimized route, saving over 90 minutes of travel time and $50 in petrol for the day.

The solution integrates directly with Azure Maps, Google Maps, Waze, or Apple Maps for real-time navigation.

5. Risk and Compliance Mapping for Lending

Australia has strict compliance requirements for lending, especially in flood-prone or bushfire-prone zones. Banks can’t just approve loans blindly without factoring in geographic risk.

Maplytics can allow banks to overlay environmental or regulatory data on top of customer and asset records. This gives risk teams visual insight with Heat Maps into exposure zones.

If a bank’s credit team is reviewing home loan applications in Northern Queensland. With Maplytics, they can overlay flood risk maps over property locations from Dynamics 365. High-risk properties are flagged automatically for additional assessment, mitigating risk before it becomes a problem.

6. Community Banking in Remote Areas

Not all Australians live in the big cities. In remote regions, branch access is limited, and internet connectivity can be patchy. Maplytics can support mobile banking units, helping teams plan efficient visit schedules and map service coverage gaps.

Suppose a regional bank in Western Australia runs mobile banking vans that serve 15 remote towns. By using Maplytics for route planning and proximity analysis, they can ensure vans spend less time in transit and more time serving communities. This kind of data-backed service delivery strengthens financial inclusion and builds trust in rural communities.

7. Fraud Detection and Anomaly Mapping

Location intelligence isn’t just about serving customers better; it can also help protect them. By mapping transactional patterns against customer locations, banks can flag suspicious activity more effectively.

Let’s say, a customer from Perth usually transacts locally, but suddenly has multiple transactions popping up from Darwin within minutes. Maplytics can visually flag geographic anomalies, enabling the fraud team to have a look and act faster.

8. Strategic M&A and Partner Location Planning

The Australian banking sector is seeing new entrants, fintechs, credit unions, and challenger banks. Traditional banks are responding with mergers, acquisitions, and partnerships. Location intelligence can play a huge role in strategic expansion planning.

Maplytics can analyse-

- Market saturation by area

- Competitor branch distribution, location-wise

- Customer demographics and business hotspots

A mid-tier bank considering a partnership with a fintech looks at overlapping and complementary geographies. Using Maplytics, they can map out existing coverage and identify high-value zones for co-branded pop-ups or shared spaces.

Think Beyond Banking Basics

- Identify footfall-heavy zones for ATM deployments.

- Map branch and customer locations against sustainability metrics.

- Geographic or territorial segmentation of high-net-worth individuals.

Why Maplytics can fit the Australian Banking Context

- Australia’s unique geography makes efficient coverage and outreach critical.

- With strict regulations on lending and property, geographic risk awareness is essential.

- Even as digital banking grows, field service and relationship management remain crucial.

- Efficient routing and branch optimization support greener banking operations.

In an industry where margins are tightening and customer loyalty isn’t very strong, time and precision equal profit. Maplytics could empower Australian banks to:

- Serve customers better with intelligent location strategies

- Lower operational costs through optimized travel and territory planning

- Make smarter lending and risk decisions

- Stay ahead of competitors with agile expansion strategies

With AI-powered search capabilities like MapCopilot and seamless integration with Azure Maps, the solution can blend real-time location intelligence with the power of CRM.

Also,

Maplytics can give financial institutions a location-powered strategy layer embedded within their existing Dynamics 365 ecosystem. Whether it’s optimizing branch networks, mitigating risk, or serving communities smarter, it can turn maps into measurable impact.

Location isn’t just where your customers are. It’s where your strategy begins.

To get more acquainted and experience Maplytics first-hand, one can write to crm@inogic.com.

We can arrange a personalized free demo for your requirements. You can also enjoy a 15-day free trial in your environment.

For applied knowledge, visit our Website or Microsoft AppSource. One can hop onto the detailed Blogs, Client Testimonials, Success Stories, Industry Applications, and Video Library for a quick query resolution. Technical docs for the working of Maplytics are also available for reference.

Kindly leave us a review or write about your experience on AppSource or the G2 Website.